Scottsdale Retirement Planning

Planning to Eat and Sleep Well Retiring in Scottsdale.

Will your life be good retiring in Scottsdale? You may not know the final results of any undersaving and investment mistakes you make for many years. It is a critically important component of your Scottsdale retirement planning efforts to save appropriately and invest wisely as you may not have the time, resources or vitality to recover from such mistakes.

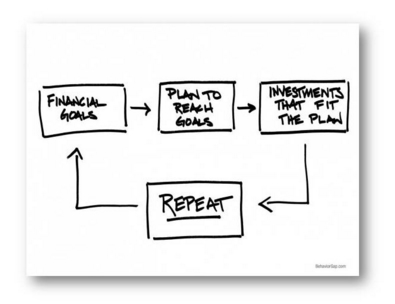

Where we fit in. To help you with your Scottsdale retirement planning efforts, we prepare informative studies that help you see if your retirement savings and investment strategies are on track to successfully support your dreams and desires, and sustain you without an earned income for as many as 30 to 40 years in retirement.

Retiring in 10 – 15 years. If you are 10 to 15 years from retiring in Scottsdale or any of Arizona’s other beautiful communities and are not sure if you may be financially underprepared for retirement, and you are committed to get prepared and focus on saving and investing, then we may be able to help. Neither markets, nor top-performing investment managers will rescue you from a savings shortfall, so your most important act will be to save, and then save more. You will need to save your earnings, your inheritance, or possibly both.

Retiring soon. If your Scottsdale retirement planning efforts are focused on retiring in Scottsdale soon or in the next few years, you are coming upon another major milestone in your life. The transition from generating a rising income from your lifetime of labor to generating a rising income from your savings will still require your labor, but with a different focus, skillsets and intelligent resources to support it.

It’s very likely that the final magnitude of your savings now measures on a much larger scale than any of the periodic contributions you made. While your success at saving helps you consider the opportunity to retire, your front-burner need is to study and analyze the likelihood that you will be able to sustain your desired lifestyle for 20 to 30 years, or more, in retirement. These studies should be robust and evaluate the adverse impacts of higher inflation, taxes and health care costs, and the difficult market environments that could lead to lower-than-expected investment returns.

One of the best ways to prepare for what lies ahead for you when retiring in Scottsdale is to work with wealth management professionals who have helped those who have gone before you. We help our clients see beyond this hard-earned moment in time, spot hidden risks, map a path and contribute our experience and resources to help them reach their goals.

Already retired. Your emotions about your lifetime savings and your investment ideas are different now. There are no more paychecks. There may be no more opportunities to “go make more.” A keen interest in a consistent and rising income, combined with a mindful and more measured eye toward risk describe you almost by definition. Now that you have more, there is so much more for you to guard and think about as part of your ongoing Scottsdale retirement planning efforts.

The complexities and workloads associated with managing wealth are more apparent to you now. Successfully managing your cash flow, investments, risks, taxes, trusts, estate plan, and your philanthropy creates multiple workflows for you. These workflows require experience, well-reasoned thought and knowledge across multiple disciplines, and consume your time and energy.

Scottsdale Retirement Planning at Intelligent Capitalworks

Wherever you are in your Scottsdale retirement planning efforts. We help our clients to become more effective CEOs of their wealth and serve them as their personal chief financial officer and as a member of their personal board of directors.

As a board member, we help provide guidance and direction, and help remove barriers. As their chief financial officer, we provide technical advice, manage workflows and help carry out processes across the many related disciplines of their wealth.

Start your Scottsdale retirement planning effort by checking your Social Security earnings and benefits statement at the United States Social Security Administration’s website (ssa.gov) and research your Medicare enrollment date requirements and benefits options at Medicare.gov.

Retirement Planning Advisor

Interview Guide

Use our proprietary interview guide, Selecting a Wealth Management Professional, in your advisor search process as you conduct your personal due diligence and dig deeper with more targeted questions during your interview with us and other Scottsdale retirement planning advisors.